Tourism in European cities grew by 3.6% in 2016

March 08, 2017

European Cities Marketing (ECM) announced a 3.6% growth in city tourism in 2016, with the domestic market increasing by 6.0% and the international market by 2.3%, respectively. The top 10 cities in terms of bednights stayed the same as the previous year, with London, Paris, and Berlin at the top of the list. Italy, Russia, and Japan continue to decrease as source markets, while the Chinese market reached a stable growth of 2.2% as of this year. For the first time in recent years, domestic bednights (6.0%) grew more than international bednights (2.3%). The preliminary data feature results from 62 out of 121 cities, representing a total of 389.9 million bednights.

Prof. Karl Wöber and Dr. Irem Önder of the Department of Tourism and Service Management were involved in researching the report, and Dr. Önder presented it at the recent ECM Spring Meeting in Gdasnk, Poland.

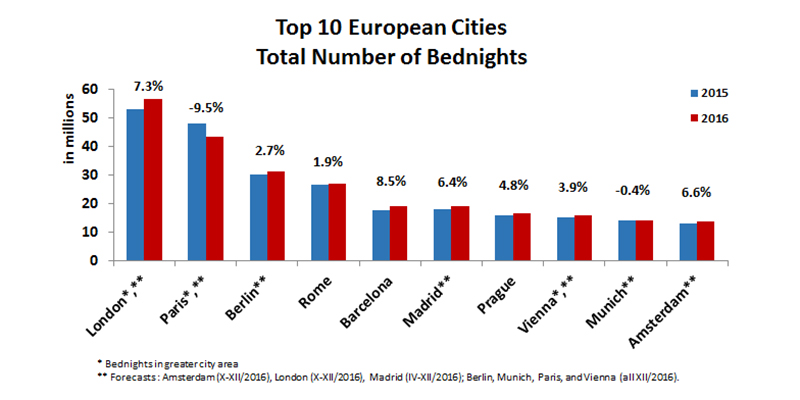

The top performing cities in terms of total number of bednights did not change in comparison to the previous year, except that Amsterdam replaced Stockholm in the top 10 list. London had the highest number of bednights in 2016 with a 7.3% increase, followed by Paris (-9.5%), Berlin (+2.7%), and Rome (+1.9%). Barcelona (+8.5%), Amsterdam (+6.6%), and Madrid (+6.4%) had the highest growth rates (excluding London).

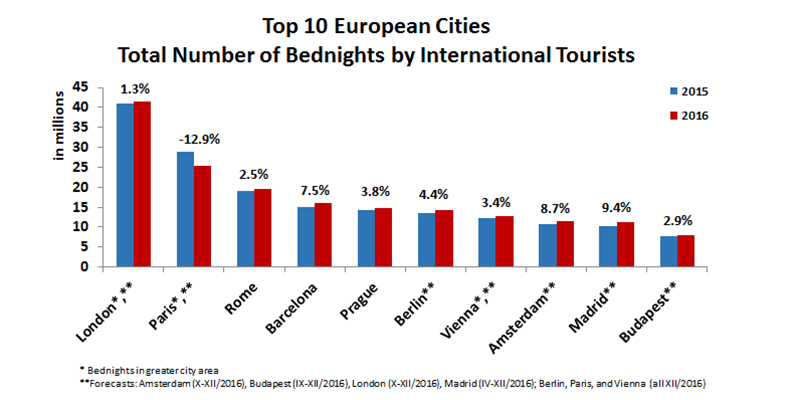

For international bednights the list of the cities is the same, however the rankings differ. London (+1.3%) and Paris (-12.9%) are the top two cities with the highest number of international bednights. The decrease in growth in Paris can be seen both in total and international bednights, which shows that although the numbers are decreasing, Paris is still one of the main city destinations in Europe. The Spanish cities of Barcelona (+7.5%) and Madrid (+9.4%) had the highest growth in the top 10 list.

Ignasi de Delàs, ECM President, explains: “We saw another exceptionally successful year for city tourism in Europe, despite major challenges arising. The terrorist attacks in Europe, and particularly in Paris, show the volatility, importance and resilience of tourism. Overseas markets such as China or Japan are particularly sensitive towards perceived risk which resulted in negative performance in 2016. However, since the last quarter of 2016 city tourism in Europe is back on track: Visitor numbers are strongly and steadily recovering for Paris as well as for source markets which were decreasing for years, such as Russia. City tourism in Europe in 2016 was “tossed by the waves but does not sink”, as European Cities remain the most attractive tourism destinations for visitors from all over the world and showed resilience and courage against terrorism.”

Main source markets USA (11%), Germany (9%), and UK (9%) make up approximately 30% of the source markets for European cities. The Chinese market, which was the fastest growing market in Europe, continued its growth with +2.2% in 2016. Italy (-4.3%), Japan (-11.8%), and Russia (-12.4%) continued their decrease, which makes up 9% of the total foreign market in European cities. Moreover, the results indicate that overall European city tourism is growing; however, this time the growth is coming from European markets rather than BRIC markets.

The 13th edition of the European Cities Marketing Benchmarking Report will be available as of June 2017, representing the leading source of European city tourism statistics in the world.